Support Masonicare Through a Donation or Planned Gift

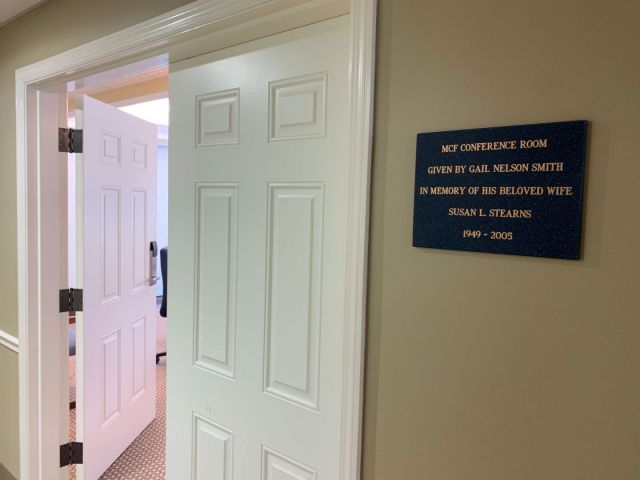

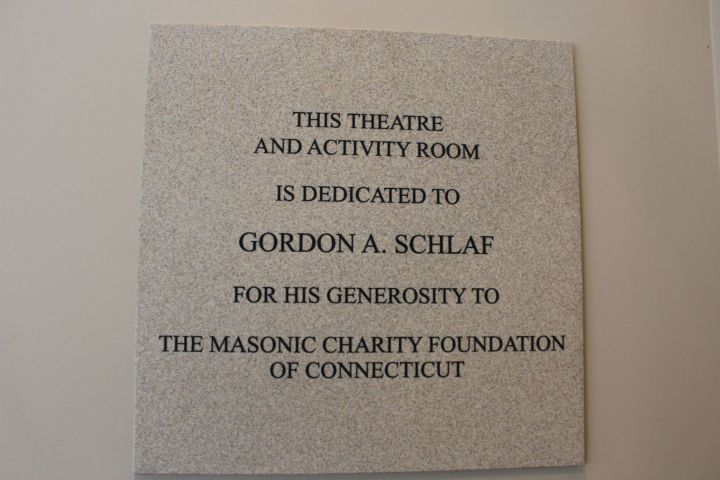

As the philanthropic affiliate of Masonicare, The Masonic Charity Foundation of Connecticut enhances the quality of life for Masonicare residents and patients in need across the continuum of care. Generous planned gifts and major gifts help Masonicare bridge the gap in funds left by declining government reimbursement, helping meet resident and patient needs when no other funding source is available.

Donations to the Masonicare Annual Appeal provide for the little “extras” that make a positive difference for our residents and patients. Long-term care residents can receive needed dental care procedures not covered by any other source, listen to the melodies of strolling musicians at their bedside, and enjoy gardening in new indoor hydroponic planters. Patients in financial need served by Masonicare Home Health receive skilled nursing and social work visits in the comfort of their own homes, as well as Masonicare medication organizers. Through gifts to the Annual Appeal, Masonicare Hospice patients benefit from complimentary, non-medical therapies like massage, music, and expressive arts.